What is Health Insurance?

"Health is like money; we never have a true idea of its value until we lose it."

- Josh Billings

You cannot enjoy wealth if you are not in good health. when you are thinking about take care of yourself, health insurance would be your ultimate back up plan. In case of a medical emergency, a health insurance permits you to focus on getting better instead of worrying about medical bills.

Our Health Insurance covers hospital bills and all the medical treatment related expenses you might face before and after hospitalization. Along with this we also have life insurance coverage with it. So, you can lay back and relax, knowing Pragati Life is always there to save you when a medical emergency knocks at the door.

Why choose Pragati Life?

Pragati Life is a trusted name in the field of life insurance in Bangladesh since 2000. With 250+ network hospitals and 25,000 agents and branches. Our objective is to make health insurance accessible for everyone so that you can stay absolute peace of mind!

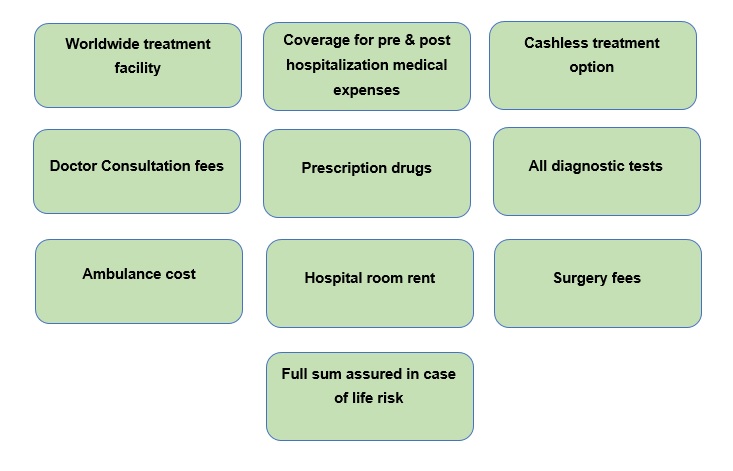

What is covered in Health Insurance?

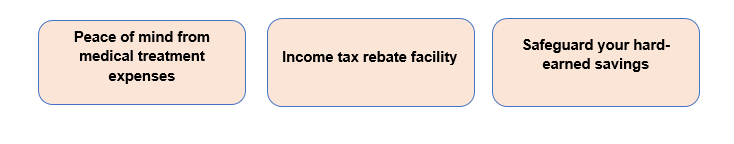

Benefits of buying Health Insurance?

How to make Health Insurance claims?

Who should buy Health Insurance?

Anyone with financial dependents should buy a Health Insurance Policy. This includes,

- Young professionals with dependent parents,

- Married couples

- Parents

- Business people

- Self-employed

According to Section 44(2) of Income Tax Ordinance 1984, premiums will be admissible for income tax rebate. Hence, it carries double benefit for taxpayers- protection and tax savings.

I want to buy Health Insurance

Downloads

E-brochure of Health Insurance

Network Hospitals [OPD Treatment]

Network Hospitals [GOP/Direct Payment]

Frequently asked questions

Insurance coverage that pays for medical and surgical expenses that are incurred by the insured person during the treatment of a disease or injury.

• Worldwide treatment facility

• During hospitalization

- All diagnostic tests

- Doctor consultation fees

- Surgery fees

• 15 days treatment cost before admission in hospital

• 30 days treatment cost after discharge from hospital

• Ambulance cost

• Nominee will get full sum assured in case of death

• Income Tax rebate facility

• Up to 45% discount in 250+ networked hospital & diagnostic center

You will get up to 45% discount in investigations in our 250+ network provider hospitals and diagnostic centers.

|

Coverage |

Plan 1 (Co-Payment 15%) |

Plan 2 (Co-Payment 10%) |

|---|---|---|

|

Life risk |

BDT 5,00,000 |

BDT 10,00,000 |

|

Hospitalization |

BDT 5,00,000 |

BDT 10,00,000 |

|

Room & Board Charge (Maximum) per day |

BDT 5,000 |

BDT 10,000 |

|

ICU / CCU / HDU |

Full Reimbursement |

Full Reimbursement |

|

Inpatient hospital costs, Operation Theatre fees, Medicines and dressings, Doctors /Surgeons fees, Nursing fees, Diagnostic tests (pathology, X-Rays, MRI, CT, PET scans), Physiotherapy and other therapeutic treatments (Insurer do not pay for Non-medical or personal items.) |

At actual |

At actual |

|

Surgical Expenses Limit |

Full Reimbursement |

Full Reimbursement |

|

Local Ambulance transport expense limit in case of emergency (per disability) |

BDT 2,000 |

BDT 2,000 |

|

15 days Pre-hospitalization, Investigation & Consultation fees |

Full Reimbursement |

Full Reimbursement |

|

30 days Post hospitalization, Investigation & Consultation (maximum 2 visits) |

Full Reimbursement |

Full Reimbursement |

|

Investigation (In Patient) |

Full Reimbursement |

Full Reimbursement |

|

Consultant Fee (In Patient) |

BDT 2,000 /Day |

BDT 4,000 /Day |

|

Ancillary Services maximum (Excluding Bed charges, investigations, surgery/ procedure fees, medicines) |

BDT 25,000 |

BDT 50,000 |

|

Exclusions |

||

|

Organ Transplant (Donor) |

Not covered |

Not covered |

|

Repatriation of remains |

Nil |

Nil |

|

Pre-existing diseases cover |

2 years Waiting Period |

2 years Waiting Period |

Yes. According to Section 44(2) of Income Tax Ordinance 1984, premium paid under this policy shall be eligible for income tax benefit.

An individual age range between 18-60 years may buy this Health Insurance policy.

• Proposal form

• Health related questionnaire

• NID/ Passport/ SSC certificate

• Passport size picture

• Nominee list

Certainly. In this case, you have to pay individual premiums based on their age.

We do not have any limitation on buying Health Insurance. It is as per your requirement if you wish to have additional coverage, however you must inform us regarding the existing policy at the time of buying.

As, this is an individual term policy, so there is no option to reduce/discount the premium.

Yes. To pre-authorize, you need to contact us at least 48 hours well in advance before any previously planned admission in hospital. If it is not possible, then you should contact us within 48 hours of an emergency admission. In such case, no penalty for failing to pre-authorize will apply.

If you receive treatment from our network provider hospital, then we will pay pre-authorized eligible treatment charges directly to the hospitals. You do not need to worry about the bill payment. You will only need to settle any charges, that are not covered by your policy directly with the hospital/doctor.

When your treatment cost is not pre-authorized or there is any out-patient or pre and post hospitalization cost, in that case you need to pay for the cost by yourself and then claim the cost for reimbursement. Claims for reimbursements should be submitted within 7 days of discharge from the hospital.

We will settle the claim within 30 days of documents submission. Provided that, all the necessary documents are submitted required by us.

An Insured need to submit following documents duly attested by him;

• Original bills, receipts and discharge certificate/ card from hospital

• Medical history of the patient recorded by hospital

• Original cash-memo from the hospital/chemists supported by proper prescription

• Original receipt, pathological and other test reports from a pathologist/radiologist including film etc. supported by the note from attending doctor demanding such test

• Attending consultants/ Anesthetists/ Specialists’ certificates regarding diagnosis and bill receipt etc. in original

• Surgeons original certificate stating diagnosis and nature of operation performed along with bills/ receipts

• Any other information required by us.

Only 30 days after the commencement of policy for medical expense incurred for any disease. However, accidents would be covered from the Day 1.

You must pay renewal premium within 30 days of your policy renewal date. If failed, we will automatically cancel your policy. If any treatment is received within these 30 days, without your premium received by us and policy reinstated, we will not cover the expenses.

In that case, you have to apply for a new policy. All the pre-existing condition will be re-verified and waiting period will apply from the start date of your new policy.

No. There is no option to get refund of premium.

Certainly. You could make any alterations only at the time of renewal. But in that case, no claim bonus will not be provided. However, any such change request will be subject to underwriting decision or requirement of medical tests on a case-to-case basis.

This is an unfortunate issue. In that case, we will provide the full sum assured to nominee.

Please visit our website www.pragatilife.com

A nominee can be anyone - spouse, children, and blood relatives. A minor (under 18) should not be declared as a nominee

Please contact Pragati Careline at 09678771208 or Tel. 02-8189184-8